A) $475,000.

B) $490,000.

C) $515,000.

D) $675,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

On January 2, 2010, Indian River Groves began construction of a new citrus processing plant.The automated plant was finished and ready for use on September 30, 2011.Expenditures for the construction were as follows:  Indian River Groves borrowed $1,100,000 on a construction loan at 12% interest on January 2, 2010.This loan was outstanding during the construction period.The company also had $4,000,000 in 9% bonds outstanding in 2010 and 2011.

-The interest capitalized for 2010 was:

Indian River Groves borrowed $1,100,000 on a construction loan at 12% interest on January 2, 2010.This loan was outstanding during the construction period.The company also had $4,000,000 in 9% bonds outstanding in 2010 and 2011.

-The interest capitalized for 2010 was:

A) $180,000

B) $48,000

C) $192,000

D) $60,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

When a company exchanges non-monetary assets and a loss results, the company recognizes the loss only if the exchange has commercial substance.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Companies account for the exchange of non-monetary assets on the basis of the fair value of the asset given up or the fair value of the asset received.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The account Deferred Grant Revenue is classified as

A) a separate component of shareholders' equity.

B) a non-current liability.

C) Other income and expense.

D) Revenue.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. Gabrielle Inc.and Lucci Company have an exchange with no commercial substance.The asset given up by Gabrielle has a book value of €120,000 and a fair value of €135,000.The asset given up by Lucci has a book value of €220,000 and a fair value of €200,000.Boot of €65,000 is received by Lucci. -The journal entry made by Lucci to record the exchange will include

A) a debit to Gain on Exchange for €20,000.

B) a credit to Cash for €65,000.

C) a credit to Equipment for €200,000.

D) a debit to Loss Exchange for €20,000.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. Equipment that cost $81,000 and has accumulated depreciation of $30,000 is exchanged for equipment with a fair value of $48,000 and $12,000 cash is received.The exchange has commercial substance. -The gain to be recognized from the exchange is

A) $9,000 gain.

B) $6,000 gain.

C) $12,000 gain.

D) $21,000 gain.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On May 1, 2010, Goodman Company began construction of a building.Expenditures of $120,000 were incurred monthly for 5 months beginning on May 1.The building was completed and ready for occupancy on September 1, 2010.For the purpose of determining the amount of interest cost to be capitalized, the average accumulated expenditures on the building during 2010 were

A) $100,000.

B) $120,000.

C) $480,000.

D) $600,000.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. A machine cost $120,000, has annual depreciation of $20,000, and has accumulated depreciation of $90,000 on December 31, 2010.On April 1, 2011, when the machine has a fair value of $27,500, it is exchanged for a machine with a fair value of $135,000 and the proper amount of cash is paid.The exchange has commercial substance. -The new machine should be recorded at

A) $107,500.

B) $122,500.

C) $132,500.

D) $135,000.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. Equipment that cost $81,000 and has accumulated depreciation of $30,000 is exchanged for equipment with a fair value of $48,000 and $12,000 cash is received.The exchange has commercial substance. -The new equipment should be recorded at

A) $28,800.

B) $51,000.

C) $30,000.

D) $48,000.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions.

Two independent companies, Hager Co.and Shaw Co., are in the home building business.Each owns a tract of land held for development, but each would prefer to build on the other's land.They agree to exchange their land.An appraiser was hired, and from her report and the companies' records, the following information was obtained:  The exchange was made, and based on the difference in appraised fair values, Shaw paid $10,000 to Hager.The exchange has commercial substance.

-The new land should be recorded on Hager's books at

The exchange was made, and based on the difference in appraised fair values, Shaw paid $10,000 to Hager.The exchange has commercial substance.

-The new land should be recorded on Hager's books at

A) $210,000.

B) $192,000.

C) $240,000.

D) $168,000.

F) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. Lee Company received an HK$1,800,000 subsidy from the government to purchase manufacturing equipment on January, 2, 2011.The equipment has a cost of HK$3,000,000, a useful life a six years, and no salvage value.Lee depreciates the equipment on a straight-line basis. -If Lee chooses to account for the grant as deferred revenue, the amount of depreciation expense recorded in 2011 will be:

A) HK$0.

B) HK$200,000.

C) HK$300,000.

D) $HK500,000.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not a major characteristic of a plant asset?

A) Possesses physical substance

B) Acquired for resale

C) Acquired for use

D) Long-term in nature

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Use the following information for questions. Lee Company received an HK$1,800,000 subsidy from the government to purchase manufacturing equipment on January, 2, 2011.The equipment has a cost of HK$3,000,000, a useful life a six years, and no salvage value.Lee depreciates the equipment on a straight-line basis. -If Lee chooses to account for the grant as deferred revenue, the grant revenue recognized will be:

A) Zero in the first year of the grant's life.

B) HK$300,000 per year for the years 2011-2016.

C) HK$500,000 per year for the years 2011-2016.

D) $HK1,800,000 in 2011.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

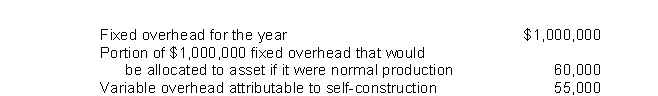

During self-construction of an asset by Richardson Company, the following were among the costs incurred:  What amount of overhead should be included in the cost of the self-constructed asset?

What amount of overhead should be included in the cost of the self-constructed asset?

A) $ -0-

B) $ 55,000

C) $ 60,000

D) $115,000

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Plant assets purchased on long-term credit contracts should be accounted for at

A) the total value of the future payments.

B) the future amount of the future payments.

C) the present value of the future payments.

D) none of these.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When a closely held corporation issues preference shares for land, the land should be recorded at the

A) total par value of the shares issued.

B) total book value of the shares issued.

C) total liquidating value of the shares issued.

D) fair value of the land.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Showing 121 - 137 of 137

Related Exams