B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

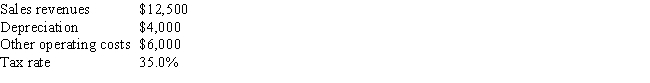

As assistant to the CFO of Boulder Inc. ,you must estimate the Year 1 cash flow for a project with the following data.What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) $5,625

B) $4,275

C) $4,388

D) $5,456

E) $4,669

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

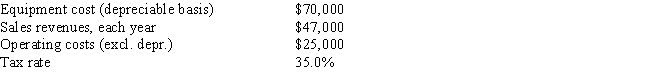

Your company,CSUS Inc. ,is considering a new project whose data are shown below.The required equipment has a 3-year tax life,and the accelerated rates for such property are 33%,45%,15%,and 7% for Years 1 through 4.Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life.What is the project's Year 4 cash flow?

A) $12,332

B) $16,335

C) $16,015

D) $14,093

E) $13,132

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) If an asset is sold for less than its book value at the end of a project's life,it will generate a loss for the firm,hence its terminal cash flow will be negative.

B) Only incremental cash flows are relevant in project analysis,the proper incremental cash flows are the reported accounting profits,and thus reported accounting income should be used as the basis for investor and managerial decisions.

C) It is unrealistic to believe that any increases in net operating working capital required at the start of an expansion project can be recovered at the project's completion.Operating working capital like inventory is almost always used up in operations.Thus,cash flows associated with operating working capital should be included only at the start of a project's life.

D) If equipment is expected to be sold for more than its book value at the end of a project's life,this will result in a profit.In this case,despite taxes on the profit,the end-of-project cash flow will be greater than if the asset had been sold at book value,other things held constant.

E) Changes in net operating working capital refer to changes in current assets and current liabilities,not to changes in long-term assets and liabilities,hence they should not be considered in a capital budgeting analysis.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Opportunity costs include those cash inflows that could be generated from assets the firm already owns if those assets are not used for the project being evaluated.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Dalrymple Inc.is considering production of a new product.In evaluating whether to go ahead with the project,which of the following items should NOT be explicitly considered when cash flows are estimated?

A) The company will produce the new product in a vacant building that was used to produce another product until last year.The building could be sold,leased to another company,or used in the future to produce another of the firm's products.

B) The project will utilize some equipment the company currently owns but is not now using.A used equipment dealer has offered to buy the equipment.

C) The company has spent and expensed for tax purposes $3 million on research related to the new product.These funds cannot be recovered,but the research may benefit other projects that might be proposed in the future.

D) The new product will cut into sales of some of the firm's other products.

E) If the project is accepted,the company must invest an additional $2 million in net operating working capital.However,all of these funds will be recovered at the end of the project's life.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Marshall-Miller & Company is considering the purchase of a new machine for $50,000,installed.The machine has a tax life of 5 years,and it can be depreciated according to the depreciation rates below.The firm expects to operate the machine for 4 years and then to sell it for $6,500.If the marginal tax rate is 40%,what will the after-tax salvage value be when the machine is sold at the end of Year 4?

A) $8,468

B) $5,986

C) $6,424

D) $7,300

E) $7,884

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The change in net operating working capital associated with new projects is always positive,because new projects mean that more operating working capital will be required.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

If an investment project would make use of land which the firm currently owns,the project should be charged with the opportunity cost of the land.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which one of the following would NOT result in incremental cash flows and thus should NOT be included in the capital budgeting analysis for a new product?

A) A firm has a parcel of land that can be used for a new plant site or be sold,rented,or used for agricultural purposes.

B) A new product will generate new sales,but some of those new sales will be from customers who switch from one of the firm's current products.

C) A firm must obtain new equipment for the project,and $1 million is required for shipping and installing the new machinery.

D) A firm has spent $2 million on research and development associated with a new product.These costs have been expensed for tax purposes,and they cannot be recovered regardless of whether the new project is accepted or rejected.

E) A firm can produce a new product,and the existence of that product will stimulate sales of some of the firm's other products.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following should be considered when a company estimates the cash flows used to analyze a proposed project?

A) The new project is expected to reduce sales of one of the company's existing products by 5%.

B) Since the firm's director of capital budgeting spent some of her time last year to evaluate the new project,a portion of her salary for that year should be charged to the project's initial cost.

C) The company has spent and expensed $1 million on research and development costs associated with the new project.

D) The company spent and expensed $10 million on a marketing study before its current analysis regarding whether to accept or reject the project.

E) The firm would borrow all the money used to finance the new project,and the interest on this debt would be $1.5 million per year.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

In cash flow estimation,the existence of externalities should be taken into account if those externalities have any effects on the firm's long-run cash flows.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Using accelerated depreciation rather than straight line would normally have no effect on a project's total projected cash flows but it would affect the timing of the cash flows and thus the NPV.

B) Under current laws and regulations,corporations must use straight-line depreciation for all assets whose lives are 5 years or longer.

C) Corporations must use the same depreciation method (e.g. ,straight line or accelerated) for stockholder reporting and tax purposes.

D) Since depreciation is not a cash expense,it has no effect on cash flows and thus no effect on capital budgeting decisions.

E) Under accelerated depreciation,higher depreciation charges occur in the early years,and this reduces the early cash flows and thus lowers a project's projected NPV.

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since depreciation is not a cash expense,and since cash flows and not accounting income are the relevant input,depreciation plays no role in capital budgeting.

B) Under current laws and regulations,corporations must use straight-line depreciation for all assets whose lives are 3 years or longer.

C) If they use accelerated depreciation,firms will write off assets slower than they would under straight-line depreciation,and as a result projects' forecasted NPVs are normally lower than they would be if straight-line depreciation were required for tax purposes.

D) If they use accelerated depreciation,firms can write off assets faster than they could under straight-line depreciation,and as a result projects' forecasted NPVs are normally lower than they would be if straight-line depreciation were required for tax purposes.

E) If they use accelerated depreciation,firms can write off assets faster than they could under straight-line depreciation,and as a result projects' forecasted NPVs are normally higher than they would be if straight-line depreciation were required for tax purposes.

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following statements is CORRECT?

A) Since depreciation is a cash expense,the faster an asset is depreciated,the lower the projected NPV from investing in the asset.

B) Under current laws and regulations,corporations must use straight-line depreciation for all assets whose lives are 5 years or longer.

C) Corporations must use the same depreciation method for both stockholder reporting and tax purposes.

D) Using accelerated depreciation rather than straight line normally has the effect of speeding up cash flows and thus increasing a project's forecasted NPV.

E) Using accelerated depreciation rather than straight line normally has the effect of slowing down cash flows and thus reducing a project's forecasted NPV.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 61 - 75 of 75

Related Exams